What Is a Balance Sheet? Definition, Explanation and Format Examples

This stock is a previously outstanding stock that is purchased from stockholders by the issuing company. If the company wanted to, it could pay out all of that money to its shareholders through dividends. However, the company typically reinvests the money into unit cost definition the company. Current assets are typically those that a company expects to convert easily into cash within a year. While stakeholders and investors may use a balance sheet to predict future performance, past performance does not guarantee future results.

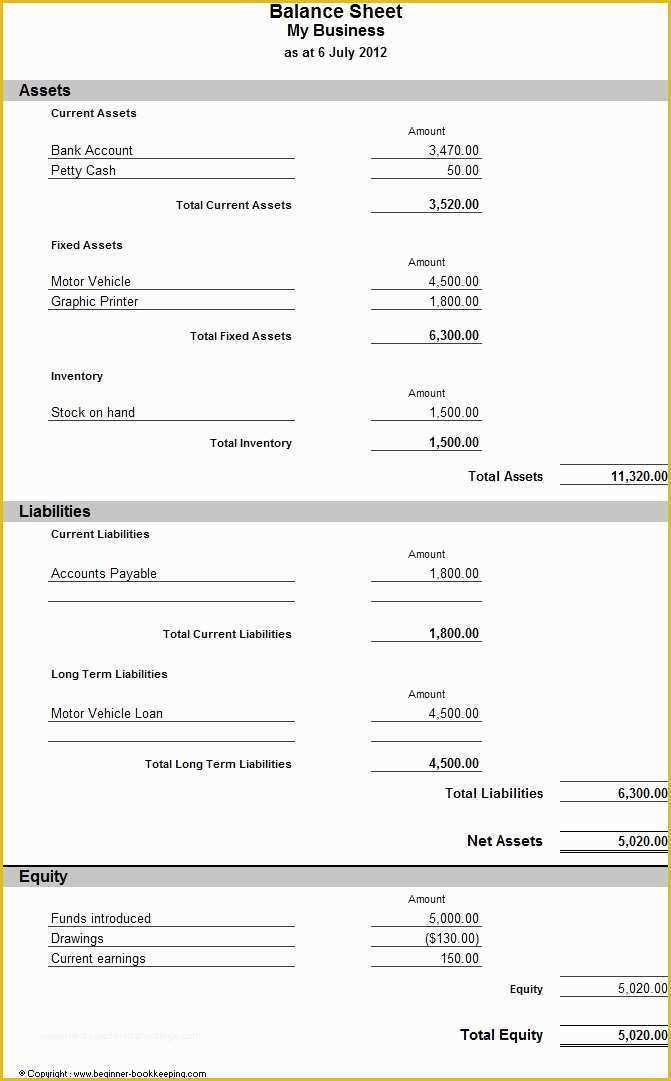

- Fixed assets or long-term assets are things a business owns that it plans to use for a long period of time.

- Returning to our catering example, let’s say you haven’t yet paid the latest invoice from your tofu supplier.

- Shareholders’ equity belongs to the shareholders, whether public or private owners.

- In this example, the imagined company had its total liabilities increase over the time period between the two balance sheets and consequently the total assets decreased.

Is there any other context you can provide?

To put it trivially, the further down you go in the list of uses, the quicker the money is available. For example, positive cash flow is available more quickly than fixed assets such as goodwill, for which you would have to wait to sell it to recover the money. Shareholders’ equity is calculated by subtracting a company’s liabilities from its assets. This shows how much of the company belongs to its shareholders or owners. The Directors Loan Account (DLA) tracks all financial transactions between a director and the company.

To Ensure One Vote Per Person, Please Include the Following Info

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Finance Strategists has an advertising relationship with some of the companies included on this website.

What is Inventory Stock?

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. The comparative balance sheet presents multiple columns of amounts, and as a result, the heading will be Balance Sheets. The additional column allows the reader to see how the most recent amounts have changed from an earlier date.

Shareholder equity or Owner’s equity is the difference between a company’s assets and liabilities. At the very bottom of the balance sheet, you will see totals for assets and liabilities plus equity. Verifying that these numbers match allows you to confirm that the data in your balance sheet is correct. It’s important to understand current vs. non-current liabilities because they affect your business differently and are listed separately on the balance sheet. The information found in a company’s balance sheet is among some of the most important for a business leader, regulator, or potential investor to understand. Whether you’re a business owner, employee, or investor, understanding how to read and understand the information in a balance sheet is an essential financial accounting skill to have.

Most of the information about assets, liabilities, and owners’ equity items is obtained from the adjusted trial balance of the company. However, retained earnings, a part of the owners’ equity section, is provided by the statement of retained earnings. The current ratio measures the liquidity of your company—how much of it can be converted to cash, and used to pay down liabilities.

The total shareholder’s equity section reports common stock value, retained earnings, and accumulated other comprehensive income. Apple’s total liabilities increased, total equity decreased, and the combination of the two reconcile to the company’s total assets. A company’s financial statements—balance sheet, income, and cash flow statements—are a key source of data for analyzing the investment value of its stock. Stock investors, both the do-it-yourselfers and those who follow the guidance of an investment professional, don’t need to be analytical experts to perform a financial statement analysis.

The accounting balance sheet gives an overview of the company’s assets, while the functional balance sheet focuses on the management and use of financial resources. It shows in one place how much the business owns (assets) and owes (liabilities). The report is used by business owners, investors, creditors and shareholders. Liabilities represent financial obligations a company must fulfil in the future, including loans and lease payments. These obligations are classified as either current liabilities, due within the forthcoming year, or long-term liabilities, due beyond a year.

Comments

No comment yet.