eCommerce Accountant & Bookkeeper For Amazon & Shopify Sellers

We offer monthly bookkeeping services and provide you a complete financial package by the 15th of each month. We use QuickBooks Online and integrate with industry leading apps to bring in the most accurate and current data from all your sales channels. Getting your VA to do it alongside any general, administrative work you assign to them isn’t much better. Unless you have defined bookkeeping systems and processes and an in-house controller managing the VA, the chances of your books being a mess are high.

Even owners with accounting experience may be hard-pressed to ensure complete and accurate financial records, especially when dealing with COGS, FBA fees, and other expenses. To keep accounts accurate, sellers often assign the entirety of this $100,000 cost to the month they purchase the inventory. The ecommerce business can anticipate contact from the assigned accountant or bookkeeper within 48 hours. The A2X Directory is a global network of expert ecommerce accountants ready to help businesses like yours.

Subscribe to the Sage Advice Newsletter

This is the amount of revenue after COGs and expenses, directly related to your primary product. We work with a wide range of businesses on a national level and can give you the friendly and expert accounting advice you need. HMRC are four letters that can strike fear into business owner’s hearts.

It’s tempting to classify the deposit entirely as sales since it’s positive cash flow into an account, but it’s actually a combination of multiple activities. While additional reconciliation may be required at the end of the fiscal quarter or year if not all inventory is sold, this approach provides a much more accurate representation of cost vs income. After an ecommerce business submits the “Match Me” form, the A2X team will look to pair them with a partner who fits the specified criteria. Capable of handling multi-channel sales – If you’re selling on multiple platforms, your accountant should be able to manage the finances seamlessly across all channels. If you are required to register for VAT for the first time, we can top 10 best mac accounting software for your small business undertake the necessary steps for you.

Do you need an “Amazon” CPA?

You can run a reconciliation report to see if there are any inconsistencies between bank and credit card statements and marginal cost of production definition what is showing up in Xero. We recommend that most businesses create cash flow forecasts at least once a quarter. You may want to do this more often if your business is prone to volatility or you are in uncertain times – like a global recession and pandemic.

Services

- You will also have the data available to back up requests to suppliers for preferential pricing or terms on future purchases.

- Having your books in order is certainly important at tax time; however, if you want to truly understand how your business is performing, it’s important to practice routine bookkeeping all year.

- Proactive approach – You want someone who takes the initiative, from conducting regular financial reviews to foreseeing challenges and providing strategic advice.

- Want to speak to an e-commerce accountant for free, get 30 minutes of expert advice on accounting for your e-commerce business.Not have any questions?

- However, occasionally one of your bank feeds might have an outage or some transactions go unaccounted for.

- Businesses with inventory are almost always required to use accrual accounting (though there are exceptions).

At the very least you will need to perform COGS calculations at the end of the year. The other aspect is asking lots of questions to learn more about them, how they work, and what processes they follow. The last part is key since both accounting and bookkeeping are process-oriented. Cloud accounting software, like Xero, is great at automatically syncing all of your bank transactions to your feed. However, occasionally one of your bank feeds might have an outage or some transactions go unaccounted for.

Our experienced and professional team can help you to extract more cash from your business by offering advice on tax efficiency, claiming tax relief and maximising your profit margin. When you set up inventory accounting properly and keep an up-to-date balance sheet, you can make decisions based on the data instead of going off intuition. You will also have the data available to back up requests to suppliers for preferential pricing or terms on future purchases. This ensures your bookkeeping is up-to-date and you have money sitting in a bank account ready to pay your taxes on time. operating expense definition Instead of frantically trying to play catch-up on your bookkeeping before the looming tax deadline or not having enough money set aside to pay the bill.

How to Get Sales on Amazon

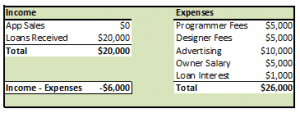

Your P&L is a report that allows you to quickly see all of your revenue and expenses in a given time period. In addition to doing your taxes, you need to have accurate bookkeeping records. Get a roundup of our best business advice in your inbox every month. As a result, relying on deposit data alone only provides part of the sales picture. To ensure consistent calculation, companies should record COGS for items sold, rather than inventory received. The result is a seemingly terrible June and great July and August, when in fact the cost of inventory actually applied across all three months.

Comments

No comment yet.